This video is translated into English. Wait for the Tax Identification Number.

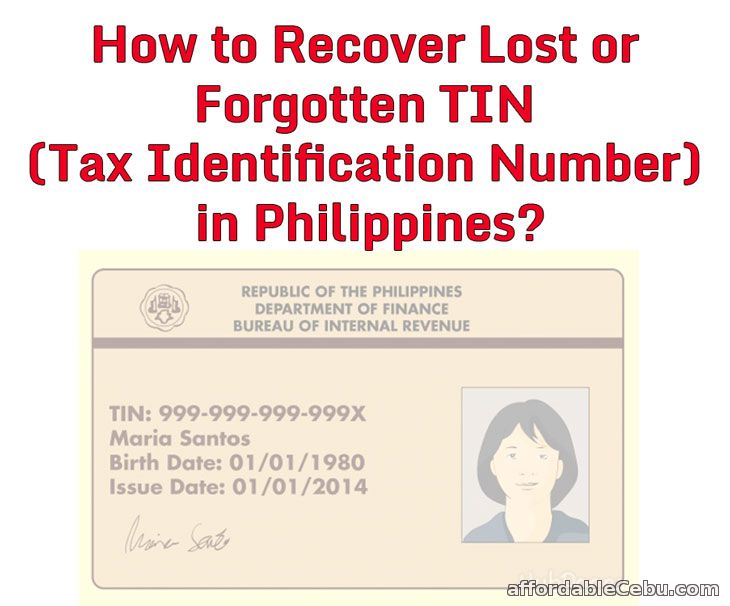

How To Recover Lost Or Forgotten Tin Tax Identification Number In Philippines Philippine Government 30213

Click the intended task to complete.

How to verify tin id philippines. Wait for an email from the BIR. I was an OFW 4 years ago. There are two TIN matching options offered through e-services.

To check Your TIN please use the process listed below. Go to the Taxpayers Service Area. Dial the Bureau of Internal Revenue trunklines at 981 7000 and 929 7676.

Your TIN is found there. Once youve completed the registration process at the BIR RDO you can already request a TIN card. If not and you were previously working try finding your old payslips or Form 2316 which is from your old company.

August 13 2021 by Eren Yeager. Request for a TIN ID. The TIN Verifier requires the user to input his or her complete name birthdate address civil status and spouse name and take a selfie together with a valid government-issued ID before.

The TIN verifier has two identified services namely TIN inquiry and TIN validation. Onboard honest customers with software that handles millions of ID verifications a year. The Electronic Audited Financial Statements eAFS is a web-based application system that enables the taxpayers to submit their filed Income Tax.

Onboard honest customers with software that handles millions of ID verifications a year. Tax Identification Number is an essential document that every Filipino taxpayer should strive to possess. Now I am about to start a new job here in the Philippines and one of the requirements po is TIN ID or verification slip.

For callers outside the Philippines dial using the Philippine country code 63 2 981-7000. The Federal Inland Revenue Service FIRS has created a way to check Your TIN. - Birth Certificate or any valid identification card that will show the applicants complete name Philippine Administrator address birth date and signature such as but not limited to.

Submit the application form and present the valid ID or NSO Birth Certificate. The user can input nameTIN combinations in groups of 25. The best place to find your TIN is through your TIN ID if you have one.

Good thing TIN verification in the Philippines can now be done online. Another way to perform TIN verification but without talking to a person is by sending an email to the BIR. Online registration application and verification.

Thank you so much. TURN ON CC Closed Captions for English SubtitlesNo NEED ID VERIFICATION HOW to CREATE your BINANCE account. Can I get the TIN ID in another branch for example BIR Tarlac.

Table of Contents hide How to Apply for a TIN Number Online as a Self-Employed Individual. Visit the BIR eReg website. As mentioned apply only if you still dont have a Tax Identification Number.

Integrated Bar of the Philippines IBP identification card. The document serves as proof of membership of the Bureau of Internal Revenue BIR and as a valid ID. For those who had a business check your 1701 or 2551 forms or a copy of your certificate of Registration 2303.

The more convenient way to apply for a TIN ID is through the online application called BIR eRegistration System. The Tax Identification Number TIN is a unique identifier for an individual or a company for the specific purpose of tax remittance and it is issued by the Federal Inland Revenue Service FIRS. I got my TIN number on 2003 in BIR San Fernando but I did not get po my TIN ID.

Getting a TIN Number to Open a Bank Account. Your support ID is. Please consult with your administrator.

Bulk TIN Matching verify up to 100000 nameTIN. Apply for a TIN ID at the same RDO that issued your TIN number. Take note that these are landline numbers so they may.

How to Get Taxpayer Identification Number TIN in the Philippines. Spouse Name if applicable Take a selfie of you together with your valid Government-issued ID and a separate photo of your government-issued ID tap the camera icon to upload a photo then tap it again to upload another one 3. Choose which one you would want to avail yourself of via the app.

The BIR recently launched the BIR Mobile TIN Verifier App 5 which is currently available for download on the Google Play Store and soon on the App Store. Ad Highly-automated identity verification service to connect companies with honest customers. Ad Highly-automated identity verification service to connect companies with honest customers.

For callers outside of Metro Manila add the area code 02 so it becomes 02 981-7000. It really is not just the quantity of data that makes organizing it difficult but in addition the issue of figuring out folks. 6 Steps in Acquiring BIR TIN ID.

There is a limit of 999 requests during a 24 hour period. How to Apply for a TIN ID Online. It should lead you to the next part of the process but in the event that no available customer service representative can assist you a pop up message would appear to notify you.

TIN Number The IRS should method an enormous quantity of knowledge involving a huge selection of millions of US citizens. Dial the BIR trunkline numbers 981-7000 or 929-7676. You wont be issued a TIN ID card if you dont have a TIN.

Professional Regulation Commission PRC identification card. Walk-in Applicants Go to your BIR RDO and sign up on the logbook of the guard your name as well as the purpose of visit. There must be considered a.

Use the TIN Verifier. How to get TIN ID in 2021. You may be required to leave an identification ID to the guard and be given a visitors pass.

Fill up the online form. Interactive TIN Matching verify up to 25 nameTIN combinations and results will be received immediately. How To Verify TIN Numbers.

How to Verify Your TIN Call the BIR. Call the BIR hotline. The Electronic Bureau of Internal Revenue Forms eBIRForms was developed primarily to provide taxpayers with an alternative mode of preparing and filing tax returns that is easier and more convenient.

The requested URL was rejected.

How To Verify Tin Number If Lost Or Forgotten An Ultimate Guide

Tidak ada komentar